In the ever-evolving landscape of financial technology, Innov8tif Solutions has emerged as a key player in providing innovative solutions to streamline processes and enhance customer experiences.

As Singapore continues to strengthen its regulatory framework to combat money laundering (AML) and counter the financing of terrorism (CFT), Innov8tif stands at the forefront, ready to equip businesses with the tools needed to help them comply with such regulations.

Understanding AML and CFT Regulations in Singapore

Singapore, being a global financial hub, has certain regulations in place to combat illicit financial activities. The Monetary Authority of Singapore (MAS) oversees the enforcement of AML and CFT regulations to ensure the integrity and stability of the financial system.

Financial institutions are required to implement robust customer due diligence (CDD) processes, monitor transactions, and report suspicious activities to the authorities.

Financial institutions in Singapore must actively implement strong controls to identify and prevent the movement of illicit funds through the country’s financial system. These controls encompass the obligation for financial institutions to recognize and understand their customers (including beneficial owners), perform routine account reviews, and promptly report any suspicious transactions.

The notice outlines the Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) requirements for banks, encompassing:

- Conducting risk assessments and implementing risk mitigation measures.

- Executing customer due diligence procedures.

- Depending on third parties when necessary.

- Managing correspondent banking and wire transfers.

- Maintaining thorough record-keeping practices.

- Reporting suspicious transactions promptly.

- Establishing and enforcing internal policies, compliance measures, audit protocols, and training initiatives.

The Objectives of Singapore’s AML/CFT Laws

There are two main objectives of the AML/CFT laws listed on the official MAS website.

- Detect, deter, and prevent money laundering, associated predicate offenses, and terrorist financing.

- Protect the integrity of its financial system from illegal activities and illicit fund flows.

What Are The AML/CFT Efforts Centred On?

According to information posted on the same website, the purpose of these regulations is centered around several factors. These include:

- Having a sound and comprehensive legal, institutional, policy, and supervisory framework

- Low crime rate

- Intolerance for corruption

- An efficient judiciary

- Close international cooperation with other jurisdictions

- An established culture of compliance

- Effective monitoring of the measures implemented

- Decisive law enforcement actions against ML/TF threats

How Does Innov8tif Comply With Singapore’s AML & CFT Regulations?

![]()

With Innov8tif’s ID assurance solutions such as EMAS eKYC and EMAS CIDA, their AI-powered components provide digital solutions that are tailored specifically to help financial institutions comply with AML & CFT regulations.

Enter EMAS eKYC

💡 EMAS eKYC is Innov8tif’s unique brand of eKYC systems that uses proprietary technology.

A significant element in fighting terrorist financing and money laundering is to Know Your Customer (KYC). KYC has become a mandatory process for many companies today and it is the primary method of identifying and verifying a client’s identity when they sign up for financial services. Innov8tif addresses this need with their proprietary identity verification and authentication solutions.

Innov8tif’s proprietary EMAS eKYC system encompasses:

- Biometric Authentication: Innov8tif offers advanced biometric authentication methods, including facial recognition and fingerprint scanning. These technologies enhance customer verification processes, ensuring that individuals accessing financial services are who they claim to be.

- Document Verification: A crucial aspect of AML compliance is the verification of customer identity through official documents. Innov8tif’s document verification tools (OkayDOC, OkayID) enable financial institutions to quickly and accurately authenticate a range of documents such as passports and identification cards. Authenticating these documents reduces the risk of fraudulent activity and also identifies potential bad actors.

- Seamless Digital Onboarding: Innov8tif’s digital onboarding solutions facilitate a seamless and secure customer onboarding process. By automating the collection and verification of customer information, financial institutions can significantly improve efficiency while ensuring compliance with regulatory requirements.

- Machine Learning Algorithms: Innov8tif leverages advanced machine learning algorithms to enhance the effectiveness of AML and CFT processes. These algorithms can analyse large datasets, identify patterns, and adapt to evolving risks, therefore providing a proactive approach to compliance.

- Compliance Reporting: Innov8tif facilitates the generation of comprehensive compliance reports, ensuring that financial institutions have the necessary documentation to demonstrate adherence to AML and CFT regulations during regulatory audits.

Enter EMAS CIDA

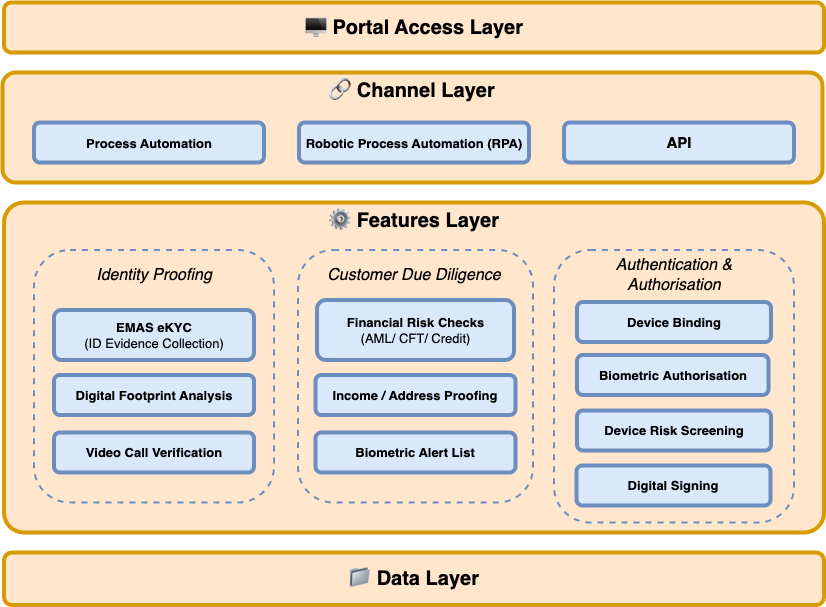

💡 EMAS Customer ID Assurance (CIDA) is a flexible, customisable, and future-proof framework that allows digital businesses to scale their 3A (assurance, authentication, authorisation) requirements.

Through EMAS CIDA, Innov8tif conducts financial risk checks that involve evaluating the risk associated with onboarding individuals or entities that may pose a liability to the business. This process is a critical component of both the Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance procedures.

Beyond identity verification, the EMAS CIDA framework also includes assessing a customer’s creditworthiness. This is to evaluate their potential to engage in financial crimes such as money laundering or terrorist financing.

Innov8tif partners with several international and local risk intelligence providers to provide the following checks:

- Credit Score

- Bankrupt List

- Sanctions List

- Politically Exposed Persons (PEP)

- Adverse Media Coverage

Benefits of eKYC for Financial Institutions in Singapore

Financial institutions adopting eKYC technology can enjoy several benefits in their pursuit of AML and CFT compliance:

- Efficiency: The automation of identity verification and compliance processes reduces manual efforts, which in turn, allows institutions to handle a higher volume of transactions without compromising on security.

- Enhanced Customer Experience: The seamless onboarding process enabled by Innov8tif’s EMAS eKYC technology improves the overall customer experience.

- Risk Mitigation: By leveraging advanced technologies, financial institutions can better identify and mitigate risks associated with money laundering and terrorist financing.

Bottom Line

Innov8tif Solutions plays a pivotal role in supporting financial institutions as they navigate the complex landscape of AML and CFT compliance in Singapore. With cutting-edge technologies and a commitment to compliance, Innov8tif Solutions empowers financial institutions to stay ahead of regulatory requirements, fostering a secure and trustworthy financial ecosystem in Singapore.

As the regulatory landscape continues to evolve, Innov8tif Solutions remains a key ally for institutions seeking to balance compliance with efficiency and customer satisfaction.

To get in touch with us, feel free to:

Contact us at [email protected]

or

Subscribe to our free whitepapers and newsletter here

To learn more about certain topics within the realm of cybersecurity or if you are simply interested in taking a deeper dive into our solutions, feel free to visit our dedicated wikipage.