EKYC EXPLAINED

Innov8tif’s ID Assurance flagship product

Helping businesses verify & activate new users anytime, anywhere, with confidence.

Something the customer owns

(e.g. ID card, registered phone)

Something the customer knows

(e.g. Personal information, PIN code)

Something the customer is

(e.g. Facial recognition, thumbprint scan)

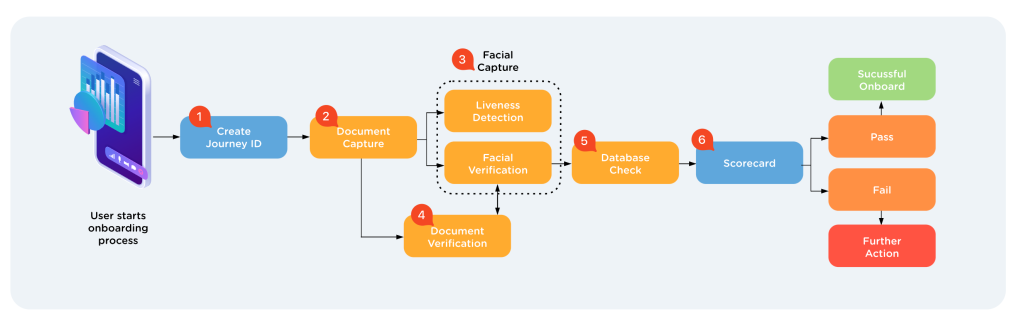

EMAS EKYC USER JOURNEY

We can customer the user journey depending on your needs.

But here's a template suitable for most user onboarding processes.

Each user signup generates a unique JourneyID, which is tracked and stored on the HIP portal.

The user first scans their ID document. With OkayID, personal details are captured automatically using optical character recognition (OCR) technology.

Beyond proof of identity, EMAS eKYC also supports proof of income and address as well.

Accepted documents:

- Passports

- National ID card

- Income/Tax statements*

- Utility bills

The user then captures a selfie for authentication purposes.

OkayLive ensures the user is a live human being, preventing common spoofing techniques used by fraudsters, such as using digital screens, printed photos etc.

OkayFace ensures that the user taking the selfie is the owner of the ID card by performing facial recognition and matching.

Data containing the user's unique facial characteristics are also stored — allowing clients to search & reference users by face via OkayFace Search.

OkayDoc checks the ID document's authenticity — preventing common spoofing techniques such as photocopied documents, forgery, photoshop attempts etc.

It detects signs of tampering, such as weird fonts, misplaced landmarks, hologram detection and so on.

The curated information is then cross-referenced against an existing database via OkayDB:

- Criminal records

- Bankruptcy status

- Politically exposed person (PEP)

- Suspicious previous signup attempts etc

The system finally generates a confidence score determining the user's legitimacy.

Through our HIP portal, clients can manually approve or reject applicants. It also contains reports and analytics on the users's onboarding process at every stage.

Information collected throughout the onboarding journey is stored on databases of the clients' choice. The system is complete with an audit trial for regulatory purposes, complete with an audit trial.

ONLY AVAILABLE IN SELECTED COUNTRIES

INDUSTRIES WE SERVE

Banks, Financial Services & Insurance (BFSI)

FinTech & BNPL Providers

Local Governments

Telecommunication

Human Resource

eCommerce

TV & Internet Providers

Logistics

Social Media

HEAR FROM OUR SATISFIED CUSTOMERS

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla pharetra felis at faucibus vehicula.

Name, Position, Company

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla pharetra felis at faucibus vehicula.

Name, Position, Company

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla pharetra felis at faucibus vehicula.

Name, Position, Company