The onset of the digital age has ushered in remarkable innovations that we never would have thought possible a decade ago. Everything, from the way we work to the way we live our daily lives, has been drastically streamlined by technological advances. However, this progress comes with a double edge, and that is the concurrent rise of fraud. The concerning part is that cyberfraud is not simply a static risk, but a constantly evolving threat. From identity theft to account takeovers, cybercriminals are quick to adapt and will not hesitate to exploit both technological loopholes and human vulnerabilities within digital systems. The real challenge for businesses now lies in predicting, detecting, and stopping these attempts before they inflict any serious damage.

What Are Fraud Prevention Measures?

Fraud prevention measures are broad in nature and can encompass a range of proactive strategies, technologies, and processes to safeguard systems, transactions, and customer data. They can include simple steps — such as verifying customer identities — to advanced analytics that detect anomalies invisible to the human eye. Some common approaches might consist of:

- Identity Verification: The process of ensuring customers are who they say they are through document checks, biometric scans, and digital ID authentication.

- Transaction Monitoring: This involves the real-time analysis of transactions to flag any suspicious patterns before financial loss occurs.

- Risk Scoring: Using behavioural data to assess a user’s likelihood of fraudulent activity.

- Regulatory Compliance: Generally involves adhering to standards like AML (Anti-Money Laundering) and KYC (Know Your Customer) to protect both the business and its customers.

While these measures can be effective individually, the real results are noticeable when combining them into a cohesive, intelligent defense system.

How AI is Changing The Game

The main problem with traditional fraud prevention methods is that they work reactively, instead of proactively. This means issues are flagged only after they have occurred. When fraud is a constantly evolving danger, waiting for it to happen is no longer a logical option.

AI fraud prevention measures address this issue by learning from historical data to spot and block suspicious activity in real time, before any damage can be incurred. In comparison to traditional fraud detection methods, having a proactive fraud detection system translates to faster detection, fewer false positives, and a safer experience for both businesses and genuine end-users.

Here are some ways AI is helping the good fight against fraud:

- Real-Time Detection and Prevention: Advanced AI systems analyse hundreds of variables and patterns in real time to spot identity fraud and other fraudulent behavior the moment they occur. This allows businesses to block or flag suspicious activity immediately to prevent potential fraud.

- Behavioural Analysis and Intent Detection: Modern AI focuses on detecting the intent behind actions rather than just identifying whether a user is human or a bot. This is done through behavioural biometrics that analyse how users interact with digital platforms and distinguish legitimate behaviour from fraudulent intent.

- Continuous Learning and Adaptation: AI fraud prevention systems continuously learn from new data and fraud attempts to adapt to the ever-evolving tactics of scammers. This makes them more resilient in terms of detection against new, sophisticated scam techniques.

- Generative AI’s Dual Role: While generative AI has enabled advanced scams like AI-generated phishing messages, deepfake impersonations, and automated large-scale fraud, it is also used by security teams to improve anomaly detection, generate synthetic training data, and assist in faster, more accurate investigations.

- Multi-Layered Defense Strategies: AI complements other security measures such as multi-factor authentication, device fingerprinting, and risk-based authentication to build layered defenses that significantly lower the chances of scam success.

- Efficiency Gains: AI accelerates investigation processes, improves accuracy in detecting fraudulent activities, and reduces false positives, leading to a better customer experience and operational cost savings.

Examples of companies using AI to combat scams include:

- DataDome , which uses AI-powered real-time behavioural analysis to differentiate legitimate from fraudulent traffic, reduces fraud losses and prevents automated scam attacks without disrupting genuine users.

- Financial institutions are deploying generative AI and machine learning models to detect sophisticated phishing, identity theft, and transaction fraud to enable proactive blocking of scams and rapid response.

- A major US bank, JPMorgan Chase, implemented AI-driven fraud detection to analyse transaction patterns and customer behaviour. It achieved a 60% reduction in credit card fraud within the first six months. The system used real-time machine learning and behavioural biometrics to identify fraudulent transactions with minimal false positives. They also combined AI with two-factor authentication and device fingerprinting for added security.

Artificial Intelligence: A Double-Edged Sword?

Companies are increasingly relying on AI to strengthen their anti-fraud strategies, using it to identify suspicious patterns, authenticate identities with greater precision, and stay ahead of fast-evolving threats. However, the same technology that empowers businesses can just as easily be weaponised by fraudsters. With the rise of generative AI, criminals now have access to tools that enable them to create highly convincing phishing emails, deepfake audio and video content, automated scam campaigns, and advanced evasion techniques designed to bypass traditional security systems.

This growing tug-of-war between defenders and attackers highlights the dual nature of AI: it is both a shield and a sword, depending on whose hands it is in. For security systems to remain effective, organisations must not only adopt AI but also continuously adapt how they use it. Generative AI can be used to create synthetic datasets that improve the training of fraud detection models, making them more resilient against emerging threats. In the same vein, it can also enable more dynamic anomaly detection, capable of identifying subtle shifts in behaviour that might otherwise go unnoticed.

The main concern lies in ensuring that defensive innovation keeps pace with offensive innovation, as fraudsters will inevitably exploit every technological advancement to their advantage. In this sense, the future of fraud prevention will not be about eliminating risk entirely, but about staying one step ahead in an ever-escalating technological arms race.

Innov8tif’s AI-powered Fraud Prevention Solutions

At Innov8tif, we believe the future of fraud prevention should be proactive, predictive, and precise. Our proprietary AI-driven solution suite integrates seamlessly into your customer onboarding and transaction workflows.

Our flagship eKYC package offers the following components:

- Liveness Detection: Prevents spoofing attempts during biometric verification.

- Facial Verification: Matches real-time images with official records to confirm identity.

- Document Authentication: Detects tampering and validates government-issued IDs.

- Risk & Fraud Scoring: Uses AI models to assess and flag suspicious activity instantly.

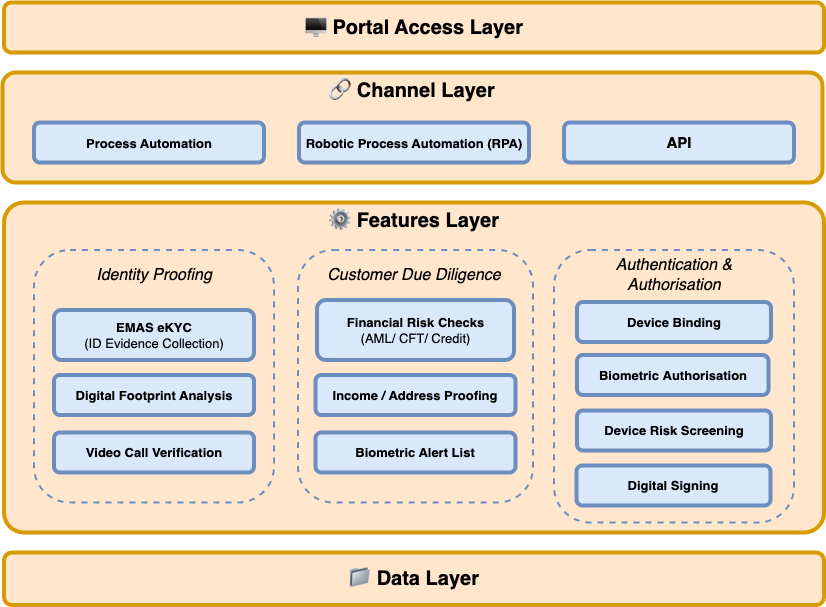

In addition to EMAS eKYC, our EMAS CIDA framework incorporates all facets of the eKYC journey alongside additional features to facilitate secure digital onboarding and customer authentication.

Beyond identity proofing, EMAS CIDA performs automated risk checks, such as AML/CFT screening, sanctions list monitoring, and proof-of-income verification to reduce financial crime exposure. Device binding and biometric authentication is also heavily embedded in this process to add an extra layer of security to ongoing user interactions.

With its modular, layered architecture — spanning data storage, identity proofing, risk assessment, and API integration — EMAS CIDA allows organisations to scale fraud prevention measures seamlessly. Innov8tif seeks to balance strong security measures with an overall smoother user experience.

The Bottom Line?

Fraud prevention has evolved from being an optional layer to a core business necessity. Cyberfraud is only becoming more complex, and the reliance on manual checks or outdated systems is no longer sufficient. With the power of artificial intelligence at our disposal, we can use it to counter the very threats that seek to misuse it for malicious intent.

At Innov8tif, our AI-powered solutions serve to both protect your business and build trust with your customers. We want to make sure that you are provided with maximum security without sacrificing even an inch of convenience.

To get in touch with us, feel free to:

or

Sign up for our free newsletters here