What is Digital Footprint?

ID Assurance is not just about verifying a person’s physical identity, but also their digital identity as well. In this day and age, email addresses and phone numbers form digital extensions of most internet users (also known as a digital footprint) — used to create any online accounts, from social media to e-commerce sites.

However, the recent rise of fake email addresses and phone numbers has proven to be detrimental to certain industries, especially those with customer journeys that span years and decades. For instance, banks, financial services, and insurance (BFSI) companies require user-submitted information to be reliable long-term for operational purposes.

Thought experiment:

Would you trust any of the following info to be genuine?

Fun fact, all the information above is fake and illegitimate.

However, users nowadays can register accounts or services using any submitted information, authentic or otherwise. Later in the article, you will find that confirmation emails and one-time passwords may not be as reliable as you expect, either.

Thankfully, Innov8tif has launched a new feature: Digital Footprint Analysis, which is designed to resolve this exact problem.

The Pain Point

Today, most companies use confirmation emails and one-time passwords (OTP) to verify user accounts. However, these systems only test the validity of email addresses and phone numbers; Not if they are genuine.

- Are OTP and confirmation links reliable?

Hence, such systems open up companies to synthetic identity theft. This is where fraudsters create false identities using a combination of real (stolen) and randomly generated data. From the account registration system’s standpoint, the user is perfectly legitimate even when they are not.

Shoddy websites offering temporary email addresses and phone numbers have helped streamline this process, allowing anyone to create synthetic fake accounts with minimal risk.

In some countries, users are required to submit ID documents to apply for SIM cards, even for temporary tourists mobile plans . Fraudsters view this as a liability, linking throwaway phone numbers to their real identities. On the other hand, creating a fake email address repository is tedious work, although providers like Gmail allow account registrations for free. Hence, these temporary email or mobile number websites enable fraudsters to scale up their operations substantially.

A quick visit to these sites shows that these services are largely used to register online accounts. Relying on OTP and confirmation emails alone is definitely not the way to ensure that your customer database is complete with high integrity.

- Digital identities are not static

Businesses should also consider that customers tend to change e-mail addresses and phone numbers frequently.

A 99firms survey showed that the number of new personal email addresses being created is growing rapidly, from 2.5% in 2019 to 7% in 2020. The average user owns an average of 1.86 personal email accounts, and the figure is expected to grow.

It is entirely possible for companies to serve emails to inactive email accounts. This hurts the effectiveness of many paid, highly-targeted, email marketing campaigns.

Solution through Digital Footprint Analysis

Introduction to DFA (Digital Footprint Analysis)

Digital footprints are digital traces users leave behind while browsing the internet. These include webinar registration, forum posts, account registrations, and even personal data and personal information — all of which are associated with a unique email address.

At Innov8tif, we have added new security features such as: Digital Footprint Analysis (DFA), into our OkayDB API component. For reference, OkayDB is an API that allows business clients to tap into specified databases to check on users’ personal information, such as credit score checks, bankruptcy records, and in some cases, social media profiles. It acts as a sort of digital identity verification to prevent cybercriminals from committing fraudulent activity.

DFA helps businesses answer the question: “How digitally active is an e-mail address based on the number of online accounts associated with it?”

This is useful information because genuine email accounts are likely to have abundant digital footprints, i.e. having plenty of associated social media accounts or comprehensive online activity. On the other hand, fraudsters are likely to create freshly created emails with no digital footprint record.

How does it work?

Stages:

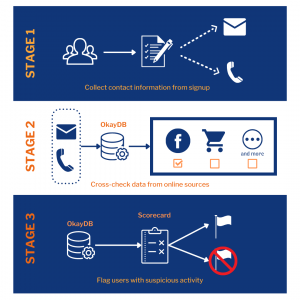

- The user first submits their email addresses and mobile phone number during account registration.

- Through process automation, OkayDB will cross-check the presence of online accounts with matching particulars via Web API.

- The results will then be aggregated, generating a scorecard depicting the user’s online activeness

Our solution is able to vet through social media sites and e-commerce platforms, such as Facebook, Google, LinkedIn, Spotify, Apple, and so on. The users’ online activity and digital profile will be then analysed to determine if their reputation is sufficient.

For the full list of platforms, feel free to get in touch with our ID Assurance experts at [email protected]!

Use cases

DFA is ideal for any financial institution or company with marketing campaigns that reward successful sign-up attempts with free trials, promotional gifts, etc. This data point can also contribute to a user’s legitimacy score during a sign-up attempt, allowing the system to flag any suspicious activities.

In relation to the previous use case, DFA is used to great effect in preventing online fraud. Online fraud often makes use of stolen personal or credit card information. To use this stolen data and evade standard cybersecurity measures, fraudsters typically create new email addresses that match the victim’s information.

This is where digital footprint analysis becomes crucial. The verification process involves analysing newly created email address set up by the fraudster by checking its approximate age using its history of data breaches. Legitimate email accounts will likely have been exposed in at least one data breach.

Additionally, a social media lookup tool can cross-reference the email address for associated accounts. An email address with no connections to any social media platform will immediately raise suspicion. Fraud prevention software can then automatically deny service or decline payment for users with a suspiciously low online presence.

These lookups only collect data that users have willingly shared publicly which avoids any controversy surrounding identifying trackers and user privacy concerns. This is beneficial as fraudsters can more easily impersonate real human traffic without access to such data from trackers. Hence, digital footprint analysis plays a pivotal role in safeguarding the bottom line of any e-commerce institution.

Instead of just the initial onboarding, DFA can be activated at regular intervals. The system can send the user an auto-reminder to update their email address and phone number if there is a decline in the account’s digital footprint.

Limitations

Digital footprints are one out of the many data points determining user legitimacy, and should not be used as the sole deciding factor.

For instance, not all consumers may have a social media account or a presence on any kind of social media platform. This includes the underserved communities living in rural groups, or the older generation. Genuine users should not be penalised for not having enough online presence. However, the lack of digital footprint serves as supporting evidence when suspicious activities are detected throughout the customer’s life cycle.

DFA may also not apply to users with multiple personal email accounts and SIM cards. Doing so fragmentises the user’s digital footprint, which may lead to a negative digital footprint score and affect reputation.

Interested to learn more about DFA? Get in touch with us at [email protected]

Subscribe to our newsletter for more product updates!

Interested to learn more about DFA? Get in touch with us at [email protected]

Subscribe to our newsletter for more product updates!